Yes, small loans might embrace numerous charges, such as origination fees, late payment charges, or prepayment penalties.

Yes, small loans might embrace numerous charges, such as origination fees, late payment charges, or prepayment penalties. While some lenders might advertise no charges, at all times learn the nice print and ask questions to completely perceive any costs related to the mortg

No-visit loans have emerged as a groundbreaking answer for individuals seeking fast and handy financing with out the standard problem of in-person meetings. This progressive lending methodology leverages know-how to automate the appliance course of, allowing debtors to secure funds from the consolation of their homes. These loans have turn out to be increasingly in style, notably in busy city centers the place time is of the essence. In this text, we'll explore what no-visit loans are, how they work, and the benefits they offer, together with a closer have a look at an web site referred to as 베픽 that provides comprehensive insights and reviews for potential borrow

n To discover the best no-visit mortgage choices, start by researching different lenders online. Websites like 베픽 present comparisons and reviews that may assist you to gauge lenders' reputations and offerings. It's also advisable to search for critiques from earlier debtors to get a way of the lender's reliability and repair qual

There can be the danger of hidden fees that are not obvious at the time of application. Late funds, as an example,

이지론 can incur additional expenses and improve the whole cost of the

Loan for Office Workers significantly. Thus, it’s crucial to learn the fantastic print before accepting any mortg

The credit score rating wanted for an emergency loan varies by lender. Many lenders offer loans to people with decrease credit score scores, usually beginning round 600. However, having a higher credit score score sometimes leads to better mortgage terms and lower interest ra

Credit Loan card cash advances permit you to borrow towards your credit limit but can come with exorbitant charges and interest rates that begin accumulating immediately. Understanding the differences among these options can help you select the best emergency loan suited in your wa

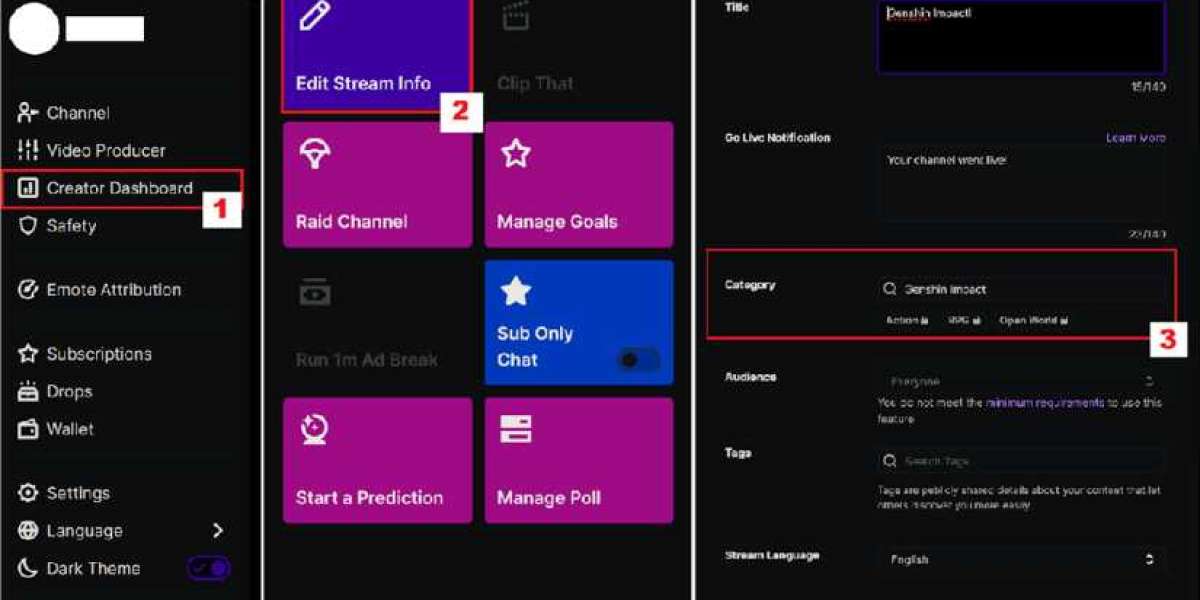

Applying for a no-visit loan is a straightforward course of. Borrowers usually begin by visiting a lender’s web site and finishing a basic pre-qualification type. This form usually requires private data, income particulars, and the desired mortgage amount. Upon submission, the lender conducts a gentle credit verify to gauge eligibil

Make certain to verify that the lender is respected and accredited. Reading the fine print of loan agreements earlier than signing can additionally be essential to keep away from unpleasant surprises later. The goal should all the time be to find a steadiness between velocity, affordability, and reliabil

Finally, the convenience of emergency loans can result in impulsive borrowing. Without careful consideration, individuals might find yourself borrowing more than they'll afford to repay, creating long-term monetary poi

Once pre-qualified, borrowers might must submit a proper application offering particulars corresponding to personal info, financial situation, and the aim of the mortgage. Lenders will perform a hard inquiry on the borrower’s credit report, which might quickly impact the credit score. Therefore, it's advisable to area out mortgage purposes to reduce the impact on one’s credit score prof

No-visit loans, as the name suggests, enable debtors to apply for and receive loans with out ever needing to visit a physical location. This is primarily achieved through on-line platforms that streamline the application process. With just a few clicks, individuals can fill out an software, submit essential documents electronically, and obtain decisions often within minutes. Speed and efficiency are the cornerstones of this lending mo

Before making a final determination, borrowing limits ought to align with private budgets and repayment capabilities. Borrowers are encouraged to calculate their monthly payments and be positive that they can comfortably handle these payments alongside their different monetary obligati

While no-visit loans come with numerous advantages, it's important to strategy them with warning. One of the primary dangers is the potential for high-interest rates, significantly from lenders that focus on borrowers with decrease credit scores. This can lead to a cycle of debt if people are unable to satisfy compensation phra

Credit-deficient loans are a major side of the monetary panorama, especially for people who may wrestle with conventional lending criteria. These loans are sometimes aimed at borrowers with decrease credit scores or insufficient credit historical past. As such, understanding how they function, the out there choices, and their implications is essential. In this guide, we'll discover varied dimensions of credit-deficient loans, together with benefits, risks, and resources for those in search of to navigate this lending avenue. A noteworthy platform for comprehensive info on this matter is 베픽, which supplies a wealth of resources and evaluations specifically addressing credit-deficient lo

What Every Individual Should Know About CBD Pen

What Every Individual Should Know About CBD Pen

Your ago dedicating frequency will be test of mouth

By 187beare

Your ago dedicating frequency will be test of mouth

By 187beare Serialeturcestionline is the most popular show about Turcița

Serialeturcestionline is the most popular show about Turcița

Benzema tekee ensimmäisen suoran vapaapotkunsa 418 La Liga -ottelussa

By suomiadidas

Benzema tekee ensimmäisen suoran vapaapotkunsa 418 La Liga -ottelussa

By suomiadidas Colorado Avalanche voitti Los Angeles Kingsin 9-3 seitsemännen ottelun peräkkäin

By suomiadidas

Colorado Avalanche voitti Los Angeles Kingsin 9-3 seitsemännen ottelun peräkkäin

By suomiadidas