Lastly, it’s vital to learn the fantastic print. Some Emergency Fund Loans could come with hidden fees or unfavorable repayment situations, making it essential for borrowers to conduct thorough analysis before committ

It’s important for potential debtors to evaluate their financial scenario before making use of. Understanding how a lot money is required and the reimbursement phrases can help in making informed selections. Additionally, checking multiple lenders for rates and phrases may find yourself in better prese

It is important for borrowers to conduct thorough analysis and understand the implications earlier than committing to a credit-deficient

Loan for Low Credit. They should also pay attention to the different varieties of lenders out there, which can vary from traditional banks and credit unions to innovative online lenders. Each possibility presents distinctive benefits and drawba

Shorter repayment terms are additionally an issue, as many credit-deficient loans could require repayment within a shorter timeframe, which could be tough for some debtors. This emphasizes the significance of having a method for managing repayments successfully to keep away from falling additional into d

Additionally, some lenders may impose hidden charges or penalties that can exacerbate the overall price of borrowing. It is significant for individuals to read all mortgage documentation fastidiously and inquire about potential further costs earlier than signing agreeme

Potential Drawbacks of Credit-deficient Loans

While credit-deficient loans provide valuable alternatives, potential drawbacks should not be overlooked. One major concern is the typically larger interest rates associated with these loans, which may result in elevated repayment amounts. Borrowers have to be cautious to assess

Student Loan phrases to keep away from unfavorable financial conditi

Through BePick, people can even achieve insights into common challenges confronted by debtors with low credit score scores, along with strategies on the means to enhance creditworthiness over time. Leveraging sources like BePick can empower individuals to navigate the lending landscape with confidence, resulting in extra favorable outco

In instances of overwhelming debt, in search of help from credit counseling providers may be appropriate. These organizations can help borrowers develop customized compensation plans and supply training on managing debt successfully, which in the end helps monetary well be

Yes, private loans are versatile and can be used for a wide range of functions, together with debt consolidation, house improvements, medical expenses, and even journey. However, it's essential to borrow responsibly and have a plan for reimbursem

According to reviews featured on BePick, many customers respect the transparency and ease of use offered by varied lenders in the Emergency Fund Loan space. Users have reported swift approval processes and pleasant customer support as crucial components of their positive experien

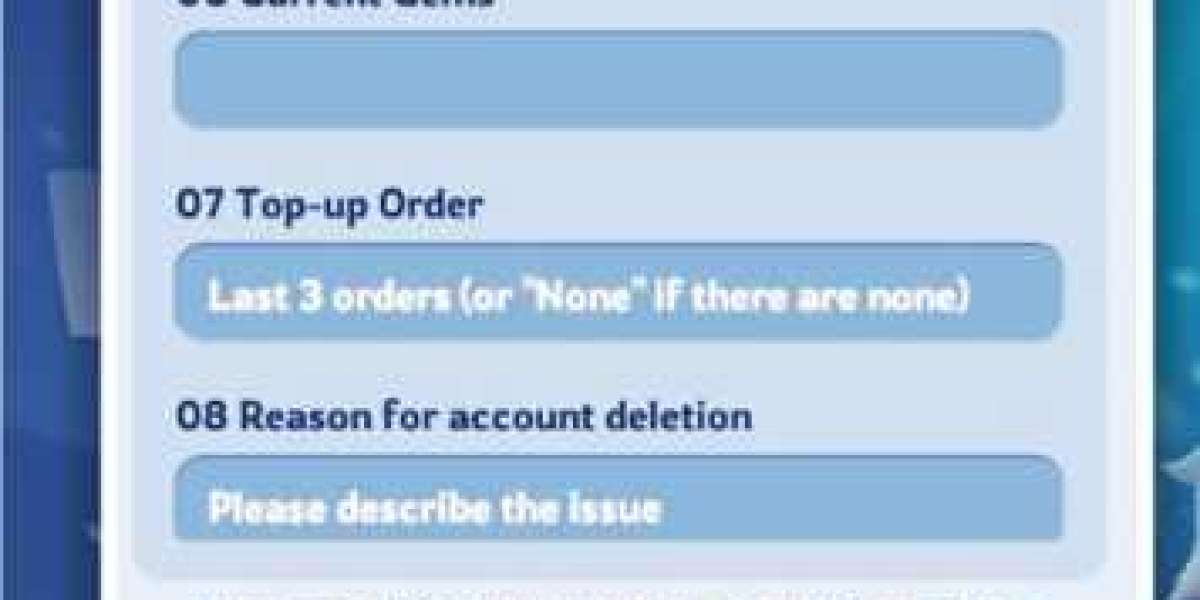

Next, prepare a listing of paperwork which could be required, including identification, proof of residence, and any present earnings sources, even when they're casual. Some lenders may also contemplate further elements such as the applicant's financial savings or financial stabil

How to Apply for a Personal Loan

The utility process for private loans can range by lender, however there are constant steps that candidates can comply with. Initially, it’s advisable to examine your credit score rating and understand your credit score report again to establish any discrepancies that could have an effect on your software. Once you have this data, you'll have the ability to set a finances based on what you can afford to re

n Housewife loans can be utilized for various functions, including house renovations, academic bills, or beginning a small enterprise. The versatility of those loans allows debtors to deal with totally different financial needs and put cash into opportunities that foster personal and family gro

If a loan turns into delinquent, the borrower risks damaging their credit score, which may hinder future borrowing alternatives. Lenders could impose late charges, initiate collection efforts, and in severe cases, the mortgage could go into default, leading to property repossession or foreclosures for secured lo

Additionally, some lending institutions have particular programs designed to help feminine entrepreneurs, additional enhancing alternatives for housewives to transition from homemakers to

Business Loan homeowners. The surge in female entrepreneurship underscores the need for supportive monetary solutions that recognize ladies's potential in enterpr

When loans turn into delinquent, monetary institutions are required to inform the borrower of their excellent money owed. This notification course of is often specified in the mortgage settlement. Over time, if the borrower fails to rectify the scenario, the mortgage could evolve right into a default standing, which leads to authorized actions, increased fees, and potentially the loss of collate

What Every Individual Should Know About CBD Pen

What Every Individual Should Know About CBD Pen

Your ago dedicating frequency will be test of mouth

By 187beare

Your ago dedicating frequency will be test of mouth

By 187beare Serialeturcestionline is the most popular show about Turcița

Serialeturcestionline is the most popular show about Turcița

Colorado Avalanche voitti Los Angeles Kingsin 9-3 seitsemännen ottelun peräkkäin

By suomiadidas

Colorado Avalanche voitti Los Angeles Kingsin 9-3 seitsemännen ottelun peräkkäin

By suomiadidas Benzema tekee ensimmäisen suoran vapaapotkunsa 418 La Liga -ottelussa

By suomiadidas

Benzema tekee ensimmäisen suoran vapaapotkunsa 418 La Liga -ottelussa

By suomiadidas